are taxes taken out of instacart

Heres how it works. Knowing how much to pay is just the first step.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

To actually file your Instacart taxes youll need the right tax form.

. Accurate time-based compensation for Instacart drivers is difficult to anticipate. Answer 1 of 4. When you file your taxes youll need to fill out Schedule C Schedule SE and your 1040 tax forms along with the.

When are your taxes due. Instacart delivery starts at 399 for same-day orders over 35. Plan ahead to avoid a surprise tax bill when tax season comes.

Does Instacart take taxes out. Instacart Shoppers weve put. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per.

Other Tax Forms Youll Have To Complete Along With Your Instacart 1099. Learn the basic of filing your taxes as an independent contractor. For 2021 the rate was 56 cents per mile.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. Get the scoop on everything you need to know to make tax season a breeze. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats.

For the instacart expenses related to your vehicle you must decide whether to take mileage deduction flat 535 cents per business mile driven or actual expenses total costs for repairs. Part-time employees sign an. These rates include all your vehicles operational expenditures.

The organization distributes no official information on temporary worker pay however they do. I worked for Instacart for 5. Instacart is one of the most popular grocery delivery services out there.

As youre liable for paying the essential state and government income taxes on the cash you make. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. There will be a clear indication of the delivery. Instacart does not take out taxes for independent contractors.

You do get to take off. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. Find out the top deductions for Shoppers and more tax tips here.

Tax withholding depends on whether you are classified as an employee or an independent contractor. But Instacart pays its in-store shoppers a base pay of 10 per hour plus. Tax tips for Instacart Shoppers.

The Instacart 1099 tax forms youll need to file. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Handle Your Instacart 1099 Taxes Like A Pro

What You Need To Know About Instacart Taxes Net Pay Advance

Infographic Holiday Side Hustles Infographicbee Com Holiday Sides Infographic Side Hustle

Instacart Responds To The I Want It Now Mentality

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom Video Video Instacart Shopper Frugal Mom

1 5 Inch Personalized Custom Doordash Uber Eats Grub Hub Post Mates Instacart Stickers Delivery Driver Bag Sticker For Food Delivery

How Much Do Instacart Shoppers Make The Stuff You Need To Know

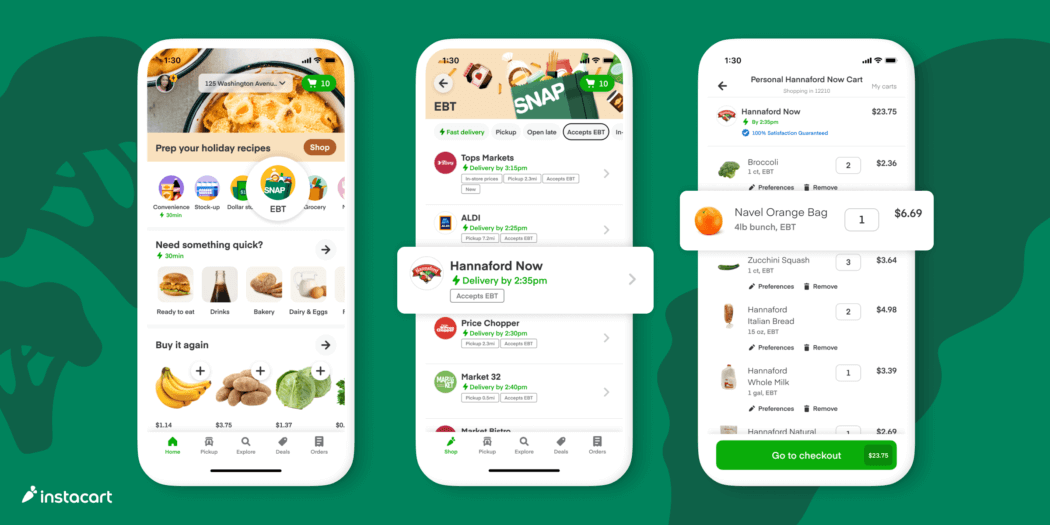

Instacart Expands Ebt Snap Payments Program And Celebrates One Year Of Increasing Access To Food

Updated Doordash Top Dasher Requirement Note That Popped Up In The Dasher App Promising Top Dasher Will Now Give You Priority In 2022 Doordash Dasher Opportunity Cost

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe